Linking Digital Customer Experiences with Business Economics

Competing in a global market nowadays has become increasingly difficult and only the creation of long- lasting competitive advantages seems to offer an avenue for success and survival. But where should an organization look for to develop a competitive advantage? Many advocate that one of the routes to reach is by means of a much stronger focus on the customer.

In the past two decades, and particularly in the process of devising an organizations strategy, a growing attention and focus on the customer resulted in an increased focus on CRM philosophies. More recently, focus on the customer revealed a more fundamental importance of analyzing the many experiences that originate as the number of digital contacts between an organization and its customers increased. In this perspective, the transaction-based notion of Customer Relationship Management is expanded to the ‘‘continuous’’ notion of Customer Experience.

The concept of Customer Experience was firstly conceived in the 80’s when a new experiential approach offered an original view to consumer behavior (Holbrook and Hirschman, 1982) Despite the initial sparks, the concept of Customer Experience came more relevantly to the fore in the 90’s with Pine and Gilmore’s book on the Experience Economy (1999). Pine and Gillmore present the ‘experiences’ as a new economic offering, which emerges as the next step after commodities, goods, and services in what they call the progression of economic value.

When it comes to Digital Customer Experiences, most organizations don’t understand what it means for them and suffer from different barriers. The barrier on one side is about executives who speak in terms of loyalty, satisfaction, and common sense. On the other side, the barrier stands those who make investment decisions and speak about the financial of profit and loss.

Investments, resources, and prioritization in Digital Customer Experience will lead to increased customer satisfaction, higher spending, reduced attrition, greater interest in other services and products and thus more revenue. Organizations who strive for optimized experiences must find a common language that links Digital Customer Experience to business economics.

In this article, I use the following definition of Digital Customer Experience

‘Digital Customer Experience originates from a set of digital interactions between a customer and a product or service, an organization or part of an organization which provoke a reaction. This digital experience is personal and relevant and involves a rational, emotional, and physical level. Its evaluation depends on the comparison between the customers expectation and the reality of the different moments of interactions'

The language of business economics

Study after study has proven that satisfied customers are more profitable than other customers. Loyal customers attrite less, spend more, recommend to others etc. On the flipside many of the causes of dissatisfaction increases company costs, for example when customers have to wait for their products, when they have to call to resolve an issue, when they don’t receive relevant information or promotions etc.

Given the relationship between customer satisfaction and financial return, translating from the language of Digital Customer Experience into the language of financeispossible.

The field of business economics provides an interesting analogy: that of elasticity. Whatever your product, there's no single price point that will make all customers buy even though none would have paid a higher price. Instead, the more the price is increased, the more customers will walk away. Lower prices will certainly drive sales, but you can't say that the price must be $Y or nobody will buy.

Digital Customer Experiences also exhibits elasticity to a certain extend. You could say that when digital customer experience is less, people are more reluctant to your product or service and when digital customer experience is high, the more products or services will be sold.

But is it true that ‘the better you do in Digital Customer Experience, the less elasticity in demand’? And does this also apply to all products and services? What about products and services that are inelastic like oil, gas, and milk?

The impact of Digital Customer Experiences on demand - Digital Customer Experience Elasticity

Different people argue that the more you invest in customer experience regardless of the cost, the greater the financial return. But in fact, the relationship between customer experience and financial return is more complex.

Meeting your customer’s digital experience expectations have positive consequences while falling short on expectations directly impact demand and retention. KPMG (2016) explained that when you failing to meet customer expectations, it will have twice the negative impact as delighting customers has a positive impact. And delighting customers reaches a point of diminishing returns quickly. In other words, the economic value for your organization is lost when experiences exceed expectations or fall short to expectations.

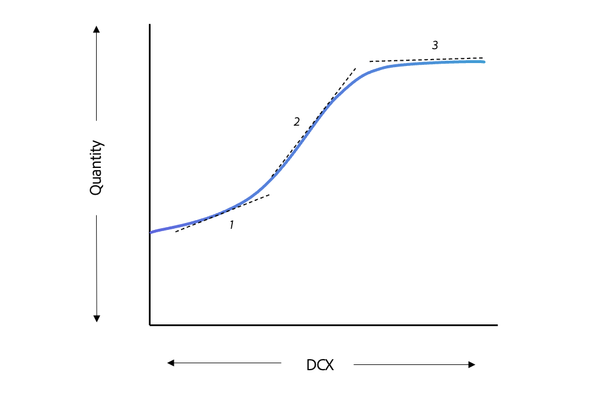

I argue that the impact of Digital Customer Experiences on demand is like ‘S-shaped curve’.The rationale behind my assertion is that without a form of Digital Customer Experiences, there is demand for a product or service (1). When the customer lives all the moments of the relationship with an organization beyond his/her expectation (Digital Customer Experiences), the demand will increase (2). But the slope flattens when degree of Digital Customer Experiences is more than the customer expects and thus has less to no positive influence on quantity (3).

Digital Customer Experience Elasticity of Demand

In my next article, I will further discuss the Digital Customer Experience elasticity of demand for elastic (comfort or luxury) and inelastic (necessities) products and services. I will draw conclusions to which extend Digital Customer Experiences will have impact on price and demand for both elastic and inelastic products and service.

Follow me on LinkedInto get a notification when my new article is published.

References

Holbrook, M. B., & Hirschman, E. C. (1982). The experiential aspects of consumption: Consumer fantasies, feelings, and fun.Journal of consumer research,9(2), 132-140.

KPMG (2016). How much is customer experience worth - mastering the economics of the CX Journey. https://assets.kpmg.com/content/dam/kpmg/xx/pdf/2016/11/How-much-is-custerom-experience-worth.pdf

Pine, B. J., & Gilmore, J. H. (2011).The experience economy. Harvard Business Press.