Creating superior customer experience has become essential for repeat purchases and customer loyalty. Satisfying experiences have been identified as critical for decades (Abbot, 1955). Pine and Gilmore (1999) introduced the experience economy and argued that organizations must orchestrate memorable events for their customers, and that memory itself becomes the product: the "experience". More lately, different scholars and analysts like Deloitte (2018) found that customers who have positive experiences with a brand spend 140% more than those who reported negative experiences.

This is not new right? Delivering customer experiences have become table stakes. We entered a new era where organizations are consciously aligning for sustainable and cost-efficient customer experiences. Research exploring the link between customer experience and sustainable business performance in terms of sales growth or profitability is underrepresented, sparse and fragmented (Gao et al., 2020).

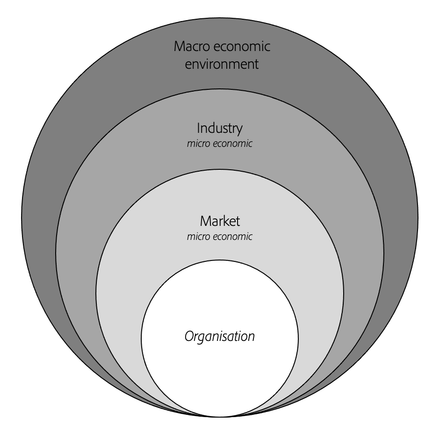

To be able to link customer experiences with business performance, it is important to better understand the different dynamics in the economic system (micro economics). In my first series of articles(see below), I linked the impact of customer experience with business economics on Market level. Market level is the place where buyers and sellers meet to engage in an economic transaction. This is where price determination take place based on supply and demand.

I used logical argumentation to introduce Customer Experience Elasticity and asserted that Customer Experiences has different impact on price and impact on quantity for a market with elastic and inelastic goods and services. In my last article, I zoomed out to industry level and asserted that digital customer experiences have a positive cushioning effect on quantity demanded in an industry at risk and a positive effect when an industry is in growth. Important to mention that my assertions in the previous articles are hypothesis and not based on empirical research.

Fig 1. Market environment Analysis Framework

Link customer experience with organizational metrics – Profitable Growth.

According to Pine and Frow (2007), customer experience affects an organizations market share, and thus provides economic value for organizations. But there is very little research which explores how customer experience links to organization performance. Wetzels, Klaus and Wetzels (2023) found evidence of a positive link between customer experience and profitability and their research lays the groundwork for research to further elaborate on the cause-effect relationship between customer experience and performance.

Like the way I linked customer experience with business economics on a market level, I argue that the same principle applies on an organizational level.

"Customer Experience Elasticity reflects the effect on profitable growth in response to a change in Customer Experience."

In this context I define Customer Experience as: the internal and subjective response customers have to any direct or indirect contact with a company and encompasses the entire customer life cycle, ranging from awareness and purchase to retention and advocacy. While profitable growth is not exact science and cannot be contained in a formula, like customer experience, I define profitable growth as the process of increasing revenue while maintaining or improving the profit margins.

I consciously use the profitable growth metric and not profitability or ‘just’ growth. After years of “growth at all costs” direction from the market and as such also the investment in customer experiences, I see a clear correction rewarding profitability. While solely focusing on growth through experiences strategies might have lost some support in this market, organizations should avoid sacrificing qualities found in a solid growth strategy. This because these traits will benefit organizations as they optimize for profitability.

Customer Experience Elasticity – my hypothesis

Customer Experience Elasticity reflects how a change in Customer Experience impact profitable growth. Every equation raises questions and so does the introduction of Customer Experience Elasticity.

My hypothesis is that when Customer Experience exceeds a certain threshold, the impact on profitable growth is lost. Which means that the optimal profitable growth from Customer Experience can be reached using the mid-point between two points. In the following figure, my hypothesis is made visible.

Fig 2. Linking Customer Experience with Profitable Growth

Research required

Like I already mentioned, different scholars and independent research firms has found evidence of a positive relation between Customer Experience and Economic returns, but there is no research about the elasticity between the two. The goal of my research * is to find answers between the two. The research will try to find answers on how to measure the responsiveness of profitable growth to a customer experience change, if the law of diminishing returns will take effect like it does in economics, and if my hypothesis is correct what impacts the magnitude, slope and steepness of the Customer Experience Elasticity curve.

For more details, please revisit https://elasticity.cx or read my previous articles on this website

If you have a view on this, or perhaps have done research before on this topic, please reach out to me. If you don’t have experience, but a view or opinion, please let me know as well! I am always curious to understand different viewpoints.

* research project is in early stages and currently being reviewed by academic leaders in this space

References

Abbott, Lawrence (1955), Quality and Competition. New York: Columbia University Press

Deloitte, The true value of customer experiences, 2018

Frow, P. and Payne, A. (2007) Towards the ‘perfect’ customer experience. Journal of Brand Management 15(2): 89–101.

Gao, L., Melero-Polo, I., Sese, F.J., 2020. Customer equity drivers, customer experience quality, and customer profitability in banking services: the moderating role of social influence. J. Serv. Res. 23 (2), 174–193.

Pine, B.J. and Gilmore, J.H. (1999) The Experience Economy. Boston, MA: Harvard Business School Press.

Rowley, J. (1999) Measuring total customer experience in museums. International Journal of Contemporary Hospitality Management 11(6): 303–308.

Digital Experiential Value

Delivering Digital Customer Experience invariably raise questions about business economics, priorities, and how to invest in it. Without a quantified link tovaluesuch efforts often can’t show clear gains and as such clear foundation to create momentum in your organisation. Read this article to understand how Icombine different classifications of Customer and Business Value and put them in the context of Digital Customer Experiences

Conscious or unconscious Digital Customer Experiences

In this article I argue that there is a great opportunity for organizations to create consious breaks in the customer journey.

Conclusion Paper Digital Customer Experience Elasticity

Download here the full paper of the three articles on Digital Customer Experience Elasticity