Organizations must accept that they have never had full control over people’s experiences, but that has never been so much of an issue. When the economy evolved around commodities, these experiences were under control of the organization. The same went for the goods economy. In the services economy things became more complex, because here the customer had to be involved in the delivery and/or the specifications of the services.

But in the experience economy (Pine & Gillmore, 2011) the situation becomes even more complex since the customer is part of the experience. The customer is not only present and involved but also decides what happens. Organizations can do all sorts of things to stage or direct the experience but in the end some minor detail that is out of the span of control of the organization, like reviews, a traffic jam on the way to an event or other personal circumstances can ruin the experience. In experiences everything is connected. The idea that organizations should be in control is founded on the assumption that organizations are responsible for providing the added value.

If organizations think they are responsible, they must come up with something better, bigger or better every time otherwise the customer may get bored. The problem is that one does not know when the customer will come back, and what he or she has experienced the last time he or she was there.

In this article, I sum up and conclude the different insights and assertions I made during 2023. I will briefly touch upon how the customers unconscious mind plays a role in delivering customer value. What customer value actually means and how customer experiences can be linked to it. The last part of this article, I will elaborate on my introduction of elasticity in Customer Experience. A phenomenon I introduced which reflects the relationship between customer experience and organizational economic results. I conclude this 2023 reflection of Customer Experience with the CX Growth flywheel. A mechanism that reflects the impact of Customer Experiences on profitable growth.

Digital Experiential Value – the customers unconscious and conscious mind (April 2023)

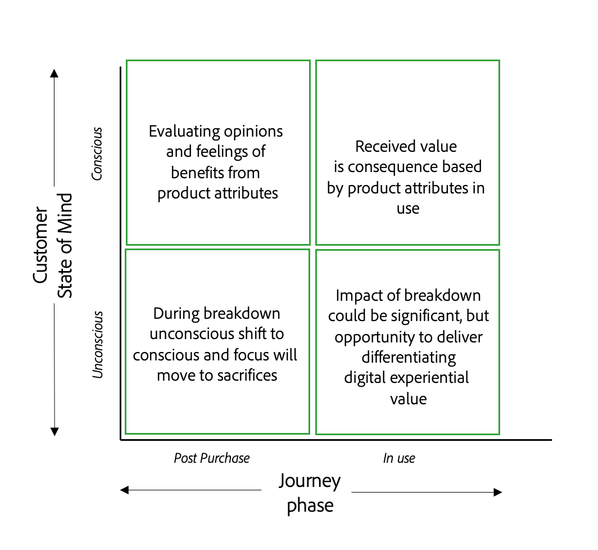

In my article about the customers conscious and unconscious state of mind (April 2023), I argue that organizations should focus on what goes on in customers conscious and unconscious mind to deliver the optimal value. I used the example of a small failure in delivering the best possible customer experience when opening a bank account. Often organizations would like to prevent that happening, but this is a great opportunity to touch the unconscious mind of the customer. This will make them aware of the next best experience you can deliver, for example a proactive reach out to help the customer where the process stalled.

Fig 1. Digital Experiential Value during post purchase and when in-use

Digital Experiential Value – link customer value with digital customer experiences (March 2023)

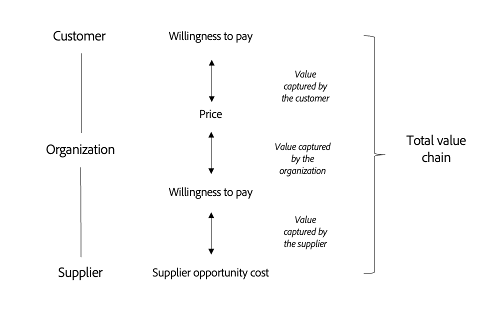

Zooming out a bit and look at 30.000 feet how a supplier and organization can add value to customers, we can use Michael Porters model from 1985 where he showed how companies add value to their raw materials to produce products that are eventually sold to customers.

Fig 2. Total value chain

How we define value is interesting. It changes from customer to customer, from organization to organization and from product to product (or service). According to Burns and Woodruff (1992) customer value is:

In addition to this, Burns (1993) explained that customer value is something perceived by customer rather than objectively determined by the seller. These perceptions involve a trade-off between what the customer receives in benefits (quality, worth, utilities) and what the customer sacrifices (price, give up to acquire).

In my article from March 23 2023, I discussed how Digital Customer Experiences affects both customer value, organizational value as well as supplier value. Clearly, for both the customer and the organisation, it is paramount to receive and create as much value as possible. Blois (2003) explained, even if a definition of customer value can be agreed, it is unclear as to exactly what form of value an organisation should pursue. It does not matter to an organisation how the customer interprets value, as long as the organisation has an understanding of what that interpretation is. It is a vital item of information that an organisation needs about its customers and is not just the core need that the product or service being offered will fulfil but in addition how the customer perceives the purchase contributing to its generation of value. It is the customer's perception of how the purchase of a product or service contributes to the achievement of its fundamental objectives that is important.

In this article (March 23), I introduced Digital Experiential Value which can be defined as the customer’s perception, which stems directly or indirectly from a person’s digital experience of the product/service. Using logical argumentation, based on the concept of Customer Experience Elasticity I introduced earlier in 2023, I argued that Digital Experiential Value has a positive impact on both customer value and organizational value.

Connecting Customer Experience with Business Economics (January 2023)

According to Pine and Gillmore (2011), Customer Experiences are a progression of economic value. This year, I have been reading quite some annual reports and delivering Customer Experiences are instrumental to create a competitive advantage. 9 out 10 annual reports I read, one of the most important strategic objectives is to improve the customer experience.

Study after study has proven that satisfied customers are more profitable than other customers. Loyal customers attrite less, spend more, recommend to others etc. Given the relationship between customer satisfaction and financial return, translating from the language of Digital Customer Experience into the language of finance is possible. In my article from January 2023 I introduced the concept of elasticity and argued that when Customer Experience exceeds a certain threshold, the impact on profitable growth is lost. Which means that the optimal profitable growth from Customer Experience can be reached using the mid-point between two points. In the following figure, my hypothesis is made visible.

In a series of articles on elasticity, I used different logical argumentations to reason how Customer Experiences impact price and quantity for elastic and inelastic products for different industries. E.g. I argue that when an industry has (some) risk to keep existing, let’s say oil and gas, the impact of Customer Experiences has a positive cushioning effect on the demand. Although you maybe can’t easily link the impact of Customer Experiences on typical micro-economics like quantity demanded and price, I am convinced that Customer Experiences has different impact on elastic and inelastic products in different industries and markets. My articles give direction and reasons for further discussion and currently I am working on academic research to better understand the relationship between Customer Experiences and economic growth. Later more about this.

Customer Experience Led Profitable growth – the flywheel concept (November 23)

The last article of 2023 was about a concept that has been introduced before, the flywheel concept. A great example of a flywheel growth model is Amazon and Uber. In this article I introduce how Customer Experiences drives both profit and growth with two different flywheels.

Fig 3. CX Led Profitable Growth Flywheel

With the flywheel concept, I explain how the investment in Customer Experiences drives customer satisfaction on one hand and competitive advantage on the other hand. As you can see in figure 3 the different loops result in Growth and Profit, profitable growth. The question is if the flywheel concept will spin endless by adding more investment in CX and employee empowerment to deliver better Customer Experiences. In line with my earlier argumentation, in this article (November 23) I argue that there is a momentum where the flywheel slows down and the impact disappears. As already mentioned, this is a hypothesis that I am currently do research on.

Wrapping it up

Customer Experience is a multi-faceted topic and has become essential for repeat purchases and customer loyalty. Satisfying experiences have been identified as critical for decades (Abbot, 1955). We entered a new era where organizations are consciously aligning for sustainable and cost-efficient customer experiences. But that is not an easy task… We can draw the following lessons based on this year’s articles:

Following blueprints like a recipe is not a solution because if everyone would follow them there would be no competitive advantage from Customer Experiences.

Secondly, be aware that not the organization but instead the individual is the center of the universe. Scarcity is not on the supply-side anymore but on the demand- side. Organizations need to think about what role they can play in supporting the individual in shaping his own experience. No full control, no zero control, but shared control. Organizations provide the ‘raw material’ and it is up to the individual what they want to do with it.

A third lesson is to think from the individuals’ perspective. The experience does not begin when they enter the building and does not end when they pass the cash register. The experience may start well before and end well after those moments, and this may all be perceived as part of the experience. Organizations need to think more in terms of chains and to look for opportunities to be of value to individuals in those processes before the enter and after they leave. Those processes are part of the experience and neglecting this is a great loss of opportunity.

This all in all, requires a mind shift. Organizations are not producers but facilitators in an Experience Economy, they should think more in terms of support than in terms of direction and they will have to get used to a more modest role in the experience economy than the full-control mode they have been used to for so long.

References

Abbott, Lawrence (1955), Quality and Competition. New York: Columbia University Press

Blois, K. (2003). Using value equations to analyse exchanges. Marketing Intelligence & Planning, 21(1), 16-22.

Pine, B. J., & Gilmore, J. H. (2011).The experience economy. Harvard Business Press.

Woodruff, R.B. Customer value: The next source for competitive advantage. J. of the Acad. Mark. Sci. 25, 139–153 (1997). https://doi.org/10.1007/BF02894350

Woodruff, R. B., & Gardial, S. (1996). Know your customer: New approaches to understanding customer value and satisfaction. Wiley.

https://hbr.org/1998/11/business-marketing-understand-what-customers-value

Digital Experiential Value

Delivering Digital Customer Experience invariably raise questions about business economics, priorities, and how to invest in it. Without a quantified link tovaluesuch efforts often can’t show clear gains and as such clear foundation to create momentum in your organisation. Read this article to understand how Icombine different classifications of Customer and Business Value and put them in the context of Digital Customer Experiences

Impact of Digital Customer Experiences on industries

In this article I argue that the impact of Digital Customer Experience has a significant cushioning effect on demand when a sector is at risk. When a sector or industry is at growth, the impact of Digital Customer Experiences is positive but less significant compared to when a sector is at risk

Conclusion Paper Digital Customer Experience Elasticity

Download here the full paper of the three articles on Digital Customer Experience Elasticity